Options are versatile financial instruments that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time. Option strategies combine calls and puts in various ways to achieve specific financial goals.

- Risk Management – Protect your portfolio against adverse market movements using strategies like protective puts and collars.

- Income Generation – Earn additional returns through strategies like covered calls.

- Leverage – Gain exposure to price movements of underlying assets with lower capital outlay.

- Market Neutrality – Benefit in volatile or sideways markets using straddles, strangles, and spreads.

- Flexibility – Customize strategies based on market outlook, risk appetite, and investment objectives.

Common Option Strategies

- Protective Put - Insurance against a decline in the underlying asset.

- Covered Call - Generate income by selling calls on owned assets.

- Collar - Limit downside risk while capping upside potential.

- Bull Call Spread & Bear Put Spread - Profit from directional moves with limited risk.

- Straddle & Strangle - Benefit from high volatility in either direction.

- Butterfly Spread - Target minimal price movement with limited risk and cost.

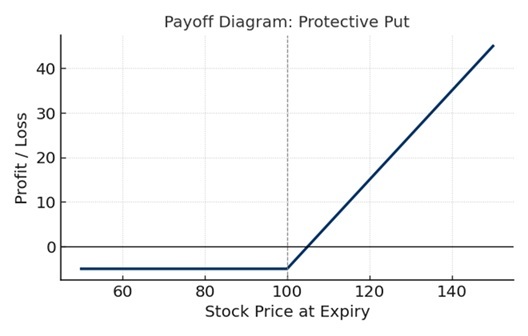

Protective Put

The protective put is a defensive strategy aimed at reducing downside risk in an existing long position. By purchasing a put option along with the underlying asset, the investor secures insurance against a decline in value. It ensures capital protection while still allowing participation in potential gains.

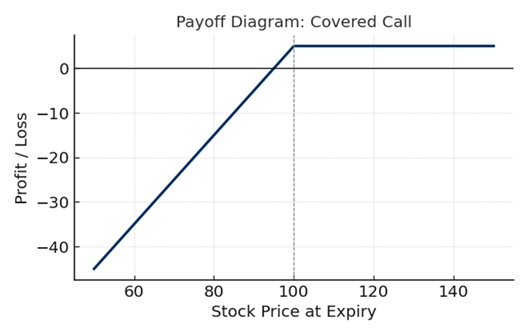

Covered Call

The covered call is an income-oriented strategy used when an investor expects neutral to moderately bullish conditions. It involves holding the underlying asset while writing a call option to generate premium income. While this caps potential upside, it provides steady additional returns when price movements remain limited.

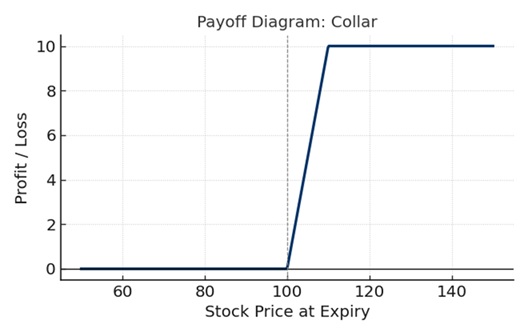

Collar

The collar strategy combines both protection and income. It is constructed by holding the asset, purchasing a protective put for downside security, and simultaneously writing a call to offset costs. This creates a price band, ensuring limited losses as well as limited gains, making it suitable for conservative investors.

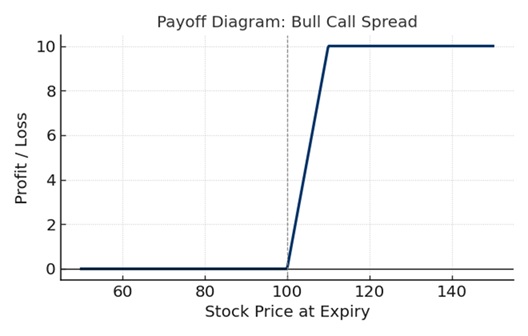

Bull Call Spread

A bull call spread is a directional strategy used to benefit from a moderate rise in the underlying asset. It involves buying a call at one strike price and selling another call at a higher strike. The strategy reduces cost compared to a single call while limiting both risk and reward.

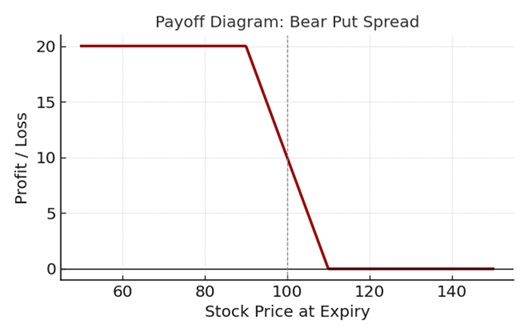

Bear Put Spread

The bear put spread is the opposite directional strategy, designed for moderately bearish outlooks. It involves buying a put option at one strike and selling another at a lower strike. This structure lowers the cost of the position and defines both maximum loss and maximum gain.

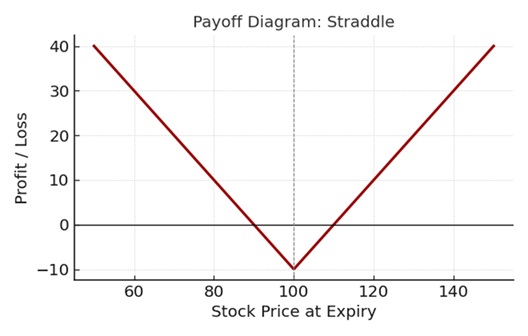

Straddle

A straddle is a volatility-based strategy created by buying both a call and a put option with the same strike and expiry. It profits from sharp movements in either direction, making it suitable when significant price swings are expected but the direction is uncertain.

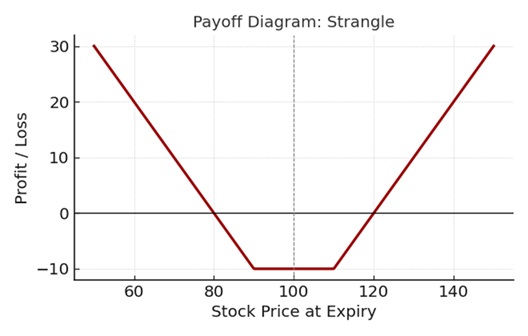

Strangle

A strangle is similar to a straddle but uses different strike prices for the call and the put. While generally cheaper to implement, it requires a larger price move for profitability. Traders use this when they expect volatility but want to reduce upfront cost compared to a straddle.

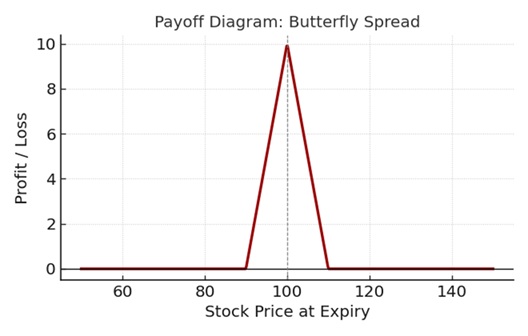

Butterfly Spread

The butterfly spread is a multi-leg strategy ideal for range-bound markets. It combines options at three strike prices to generate limited profit if the underlying asset remains close to the middle strike. This strategy is best suited for low-volatility conditions and helps define both risk and reward clearly.